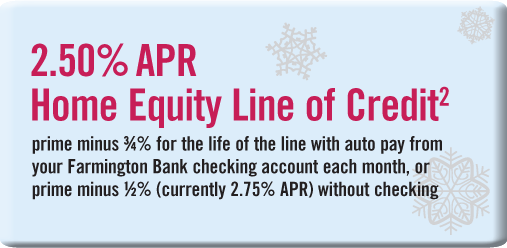

2 Offer applies to new Home Equity Lines of Credit on owner-occupied primary residences within the state of Connecticut and is effective as of December 15, 2011 and is subject to change at any time without notice. The 2.50% APR is variable based on the Prime Rate as published in The Wall Street Journal (3.25% as of December 15, 2011) minus 0.50% plus an additional 0.25% rate discount when you arrange to have payments made automatically through ACH from your Farmington Bank personal checking account. If you cancel the auto pay during the life of the loan, the APR will revert back to Prime minus 0.50%. Without automatic payments from a Farmington Bank personal checking account, the APR would be 2.75% variable based on the Prime Rate minus 0.50% as stated above. The APR may vary and your minimum payment may increase or decrease. You can obtain credit advances for nine (9) years and ten (10) months during the "draw period" and make monthly interest payments (and principal if you wish). After the draw period ends, you will no longer be able to obtain credit advances and you must pay the outstanding balance, in monthly installments of principal and interest over the next twenty (20) years (the "repayment period"). The APR can never go below 0% with a maximum of 18%. A $50 annual fee applies. A prepayment penalty of $500 will be imposed on all new accounts cancelled within 24 months of origination. The minimum loan amount is $10,000. Maximum Combined Loan to Value (CLTV) is 80%. Property insurance and flood insurance, if applicable, are required to be maintained for the life of the loan. Loan is subject to credit approval.